Robinhood tax calculation

Stocks held longer than a year get. If youre a single taxpayer in 2021 the government allows you a standard deduction of 12550 25100 if married filing jointly.

The P L Chart Robinhood

Effortlessly calculate your Robinhood crypto taxes and generate the right tax reports to send to your tax authority.

. Any information found on Forms 1099-DIV 1099-MISC 1099-INT and 1099-B. Sum of all the money received from selling the shares - Sum of all the money spent on the trades EXCLUDING the ones you still hold Net Profit Take the net profit and figure out what. Robin Hood Tax Services believes in building relationships with our clients and we view these relationships as partnerships.

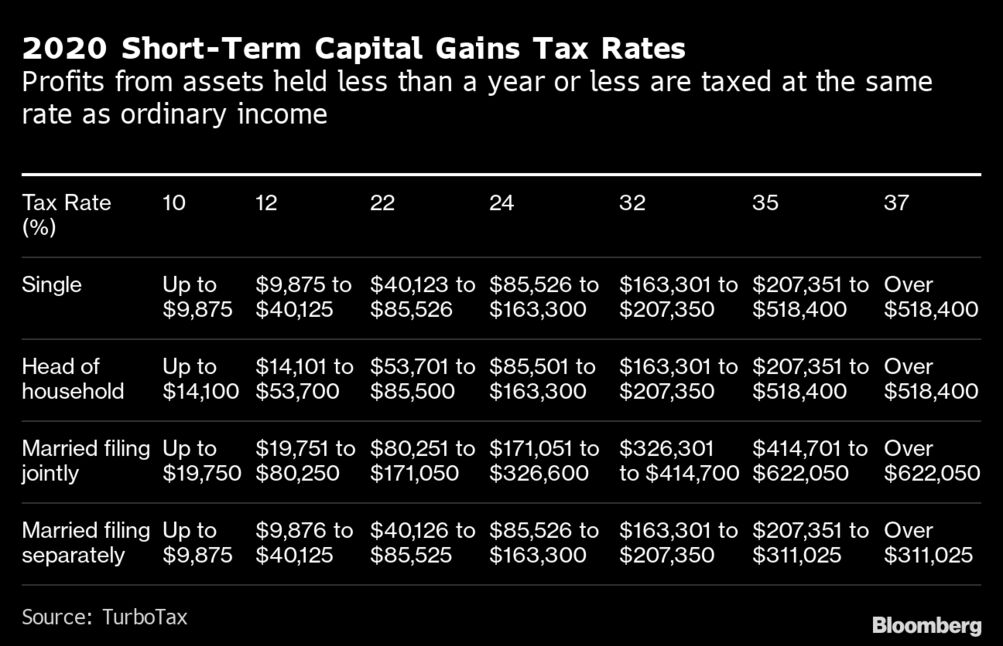

Any investments that you sold on Robinhood that you held for 1 year or less will be short term capital gains. Robinhood doesnt have a tax API just yet - but watch this space. IRS Publication 550 Taxation of.

Then any losses you incurred that year will offset those long and. Well also begin 24 backup tax withholding on your Robinhood Securities account. Sum of all the money received from selling the shares - Sum of all the money spent on the trades.

If youd like to use a crypto tax app to calculate your Robinhood crypto taxes youll need to get a CSV file of your. It will be your job to report this data on your tax return once youve received your Robinhood markets tax forms. As a Robinhood client your tax documents are summarized in a consolidated Form 1099.

Our service is founded on the commitment dedication and. What is Robinhood Taxes. That means that all cash proceeds including future sell orders dividends interest and certain other.

The tax will now range from 0 to 20 depending on the investors annual income. So in this example that would leave. Robinhood tax calculation Rabu 21 September 2022 Plus Tax Amount 000.

Stocks held less than one year are subject to the short term capital gains tax rate which is the same tax rate you pay on your ordinary income. How to Connect Robinhood Crypto and Koinly. State taxes may vary.

About tax documents How to access your tax documents How to read your 1099 How to correct errors on your 1099 How to upload your 1099 to TurboTax Finding your. Remember capital losses may help offset capital gains.

How To Read Your 1099 Robinhood

How To File Robinhood 1099 Taxes

Crypto And Taxes The Basics Part 1 By Dorian Kersch Lunafi Blog Medium

Robinhood Taxes Explained How To File Robinhood Taxes On Turbotax Youtube

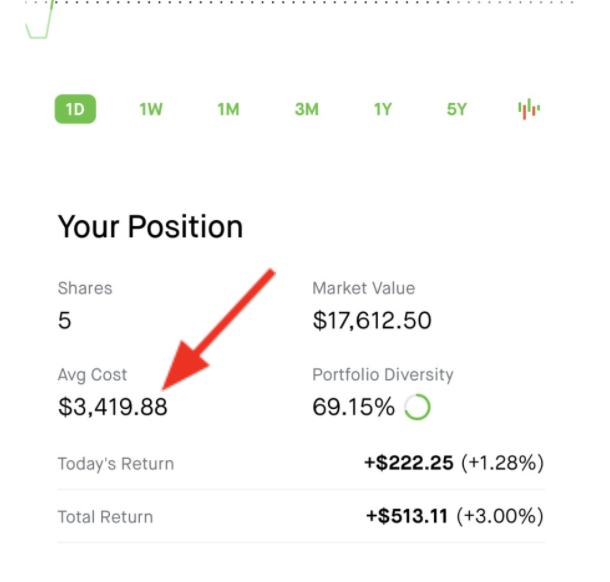

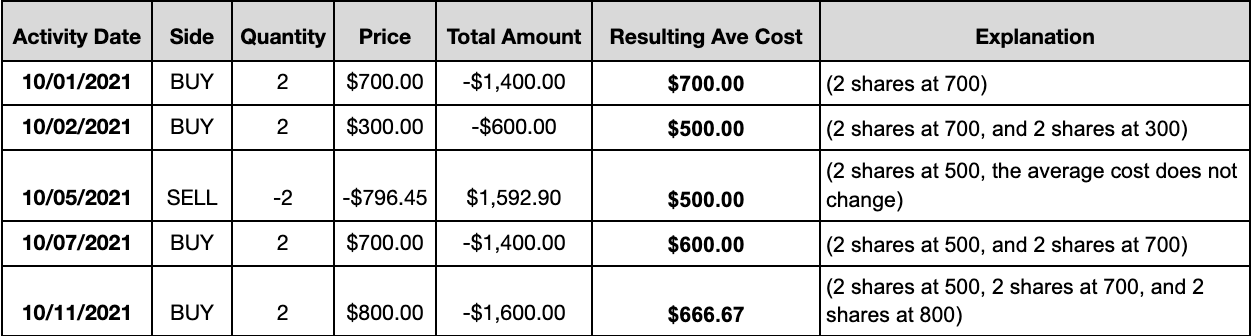

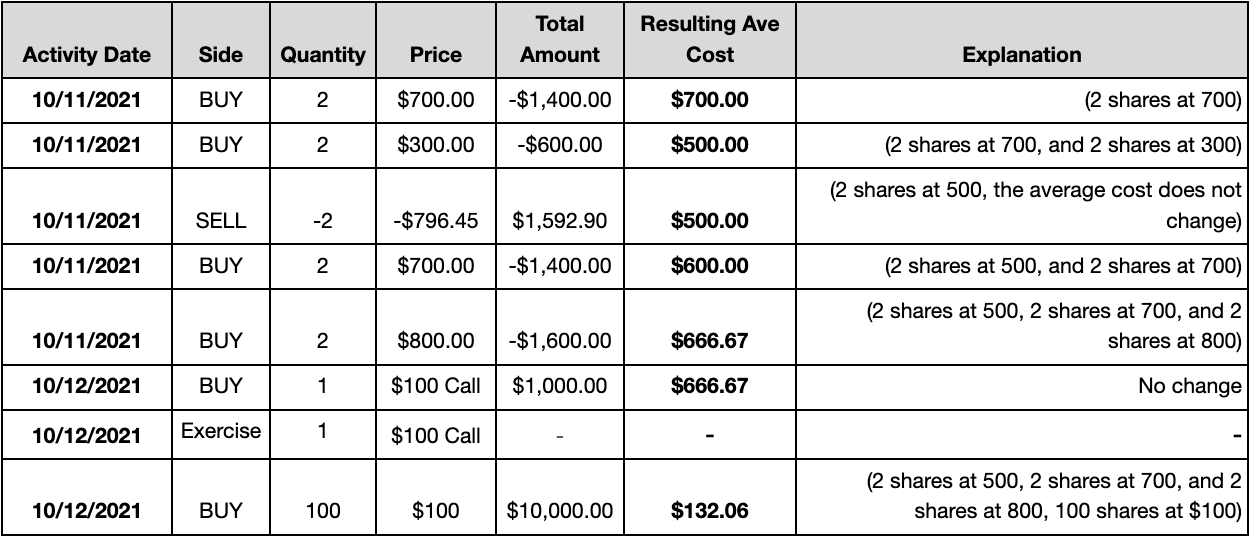

Average Cost Robinhood

Average Cost Robinhood

Cryptocurrency Taxes Guide 2022 How Why To Report Your Profits

/1099B2022-95af0a55817a4b8ea69f159a8c8451c1.jpg)

Form 1099 B Proceeds From Broker And Barter Exchange Definition

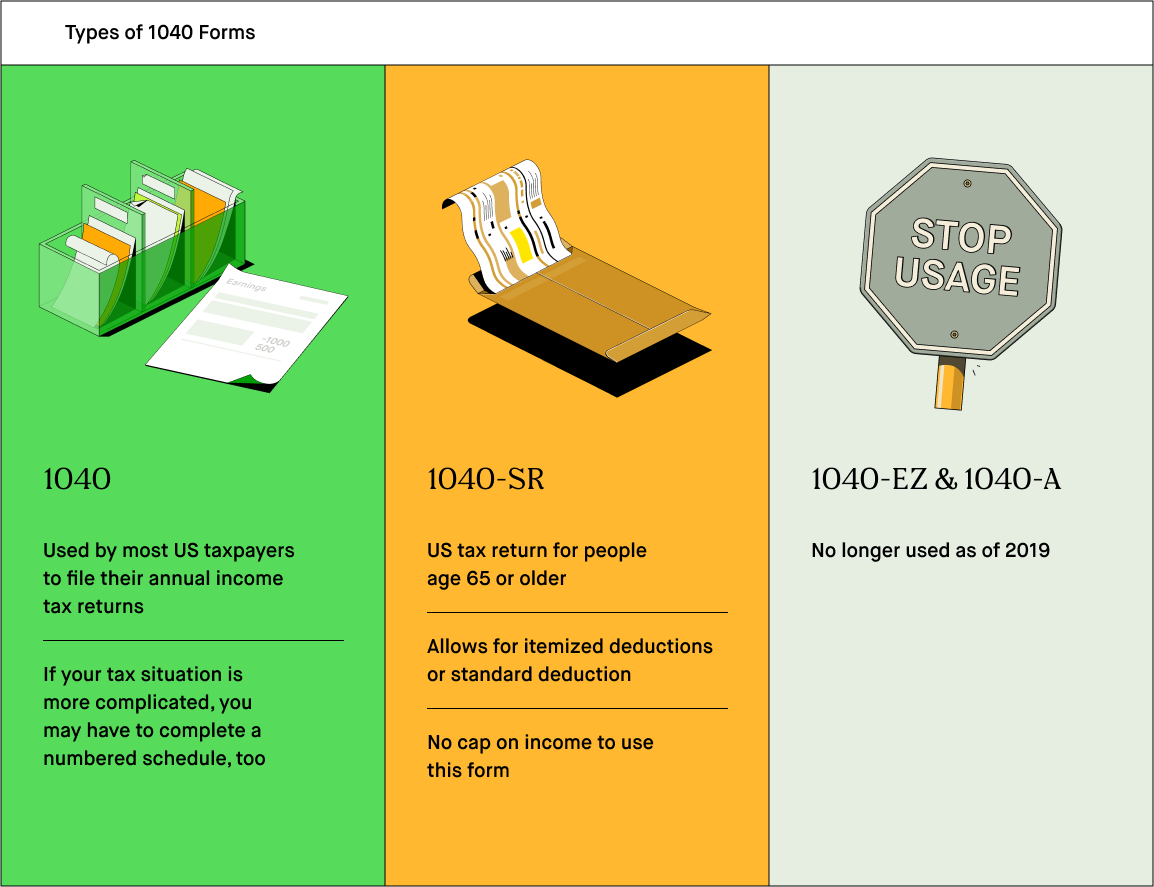

What Is Form 1040 Robinhood

United States What Are The Requirements To Not Report All Stock Transactions On The Tax Return 1099 B Personal Finance Money Stack Exchange

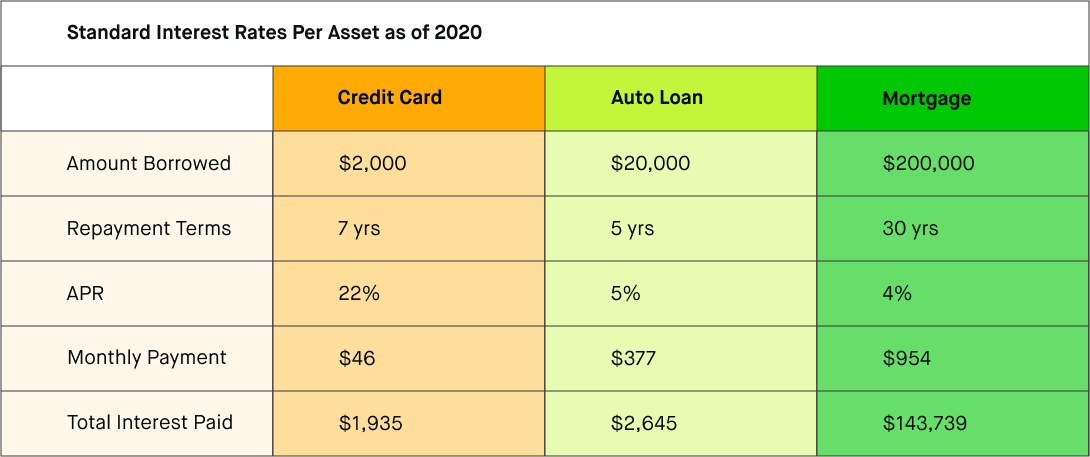

What Is Property Tax 2020 Robinhood

How To Read Your Brokerage 1099 Tax Form Youtube

How Do You Pay Taxes On Robinhood Stocks Benzinga

Average Cost Robinhood

What Is Rate Of Return Ror

Robinhood Taxes Explained Youtube

Robinhood Investors Confused Over How Much Tax They Must Pay For Trading Stocks Bloomberg